Since the Federal Reserve raised interest rates in April, the encryption market has been in a full decline and gradually turned bearish with the occurrence of several black swan events. The income of the secondary market looks quite bleak. Mainstream assets such as Bitcoin and Ethereum have fallen by more than 50% in just two or three months, moreover Bitcoin and Ethereum are leading the decline in the market. Relatively robust hedged assets rarely appear in the secondary market.

The downturn of the market means a large amount of funds fleeing. In addition to the secondary market, DeFi is also gradually losing liquidity due to the flight of funds. The income of DeFi mainly relies on the liquidity of the market. For example, in 2020 and 2021, vault products, yield aggregator products, and liquidity mining had all provided super high income under the premise of sufficient liquidity. When the market liquidity is insufficient, DeFi’s overall yields look quite weak, further resulting in poor investment activity of investors and potential investors, and DeFi gradually forms a death spiral of lack of liquidity and weak yields.

From the perspective of the primary market, there are currently more than a dozen Web3 unicorn institutions, whose OTC valuations have dropped by more than 50%. Among them, there are many star unicorns such as OpenSea, FTX, and ConsenSys, and the highest valuation has even dropped by up to 90%. Facing an unprecedented “market crisis”, encryption capitals are tightening their investments, which means that yields brought by the primary market are increasingly “unsatisfactory” for investors.

Therefore, for investors, especially retail investors, at the current stage, whether it is the primary market, the secondary market or the DeFi market, it is difficult to obtain considerable profits. Steady yields are prominently necessary in a bear market, especially for many Holders, they need safe and reliable investment products to improve the utilization rate of capitals and hedge against potential risks faced by the market. In this case, we see that quantitative arbitrage may be one of the best solutions for achieving robust, reliable yields.

The Benefits Of Quantification

From an investment point of view, investors, especially retail investors, usually like to gain profits by their own, such as buying at a low price and selling at a high price at a low frequency through the trading platform, and discovering on their own the potential profit-winning opportunities in the market like liquidity mining of high APY, Staking, etc. The disadvantage of this method lies in that it is difficult to accurately grasp the best profit-winning timing of the market due to human subjective judgment. Situations like zero profit and loss may even occur.

Quantitative transaction, on the other hand, is one of the best profit-making methods with stable and reliable yields. Quantitative transaction is an investment behavior that makes decisions through data and models. It replaces human subjective judgments with advanced mathematical models, and utilizes computer technology to select a variety of “high probability” incidents that can bring excess yields from vast amount of historical data so as to formulate strategies, which greatly reduces the impact of subjective emotional fluctuations and avoids irrational investment decisions in the case of extreme mania or pessimistic emotions in the market.

Through the quantitative system to arbitrage according to the quantitative strategy, users will acquire stable yields. It can not only overcome the shortcomings of human decision-making, but also has strong characteristics for verification and replication. From the perspective of the traditional financial market, 10% to 20% of the transactions in the stock index and futures market are realized through quantitative transactions, and in the field of cryptocurrency, quantitative transactions are also becoming a new favorable way for arbitrage to more and more investors.

IMC is a new generation of quantitative arbitrage ecology. Based on the traditional quantitative system, AI technology is further introduced to update the quantitative strategy of the system to further maintain the efficiency and accuracy of arbitrage. IMC will be committed to building a full-category AI intelligent quantitative investment platform, realizing the popularization of quantitative investment, providing quantitative tools/quantitative products, and allowing users to equally participate in investment and obtain yields. IMC mainly focuses on the cryptocurrency market and adopts the world’s top cryptocurrency-based quantitative strategies to maximize quantitative investment returns for users.

Industrial Advantages Of IMC Quantitative System

Cryptocurrency is a new type of finance, and its development history is relatively short compared to traditional finance. Therefore, in the quantitative sector, the overall quantitative system for cryptocurrencies is not perfect, and there are certain bottlenecks in terms of functionality and stability.

IMC is a leading global investment management firm focused on alternative investments. The company’s origins can be traced back to 2013, when its co-founder Reid Bloom filed for the company’s first patent, an artificial intelligence transaction learning system. Since its development in 2013, IMC has obtained leading industry decision-making algorithms from more than 30,000 high-net-worth investment users. The company’s developers and operation team as of early 2022 had officially exceeded 200 people. At the same time, its self-developed AI intelligent quantification system has always maintained an annual transaction volume increase at more than 13% for the past 10 years. Therefore, in the field of AI and quantification, IMC has equipped itself with a considerably vast amount of industry experience, and the quantitative system is far ahead of the basic level of the industry.

In the quantitative system of IMC, the AI intelligent quantitative algorithm can integrate the factors generated by each node on the data chain and encrypted derived data into a new transaction decision-making factor pool. It also can provide appreciation services including digital assets, digital asset management for different scales, multi-signing technology services provided by IMC, system multi-language support services, digital asset trading services, risk-free digital high-frequency automatic quantitative trading asset services, user high-frequency automatic quantitative trading services, etc.

While giving full play to the three advantages including complete trading varieties, open financial community, and rich financial tools, IMC also deeply studies management traditions and the institutional experience of third party capital, and has established solid relation service providers and trading counterparties across the entire blockchain and within the digital asset ecosystems and institutions.In addition, IMC is also actively exploring cooperation with Coinbase and other encryption related institutions, and will further expand its ecology to the Metaverse, Web3 and other fields in the future.

At present, the IMC quantification system has been officially opened to investors, and has gained unanimous praises from the industry and users. From another perspective, IMC has also built a powerful income system that can bring investors far more income than other quantitative ecosystems.

Analysis of IMC Quantitative Ecological Benefit System

The IMC ecosystem can not only provide users with static quantitative income based on the quantitative system, but also have a dynamic income system to further support investors to obtain substantial income in a bear market.

When users use the IMC quantification system, they will have two choices: investing capitals and quantifying times. The longer the time be engaged in the regular investment and the more funds being input, the higher the yields would be

Overall, there are two types of income, that is , static income and team dynamic income.

At present, the IMC quantitative system has opened four investment cycles, including four types of products which are at 3 days, 60 days, 90 days and 120 days. The corresponding static income values are as follows:

We can see that the longer the regular cycle for investment is, the higher the interest rate will be. Each user can only purchase an experiential product of 3-day as a cycle three times. The system will calculate the income every hour, and the income can be reinvested at any time or be withdrawn at any time.

In addition to static income, the IMC quantification system also includes a dynamic income model (it requires the participation into buying products with a static income of more than 60 days). This model sets 5 levels, and investors can form a team to win higher returns.

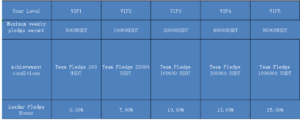

Usually, the minimum limit for users to start investing is 100 USDT, and at the same time, they can form a team, and the team will obtain a different VIP level based on its overall capital volume. For example, when the team’s capital volume falls into the range of 100 USDT-19999 USDT, the team as a whole is at the VIP1 level, when the team’s capital volume falls into the range of 20000USDT-100000USDT, the team as a whole is at the VIP2 level, and so on. When the team as a whole reaches capital volume for the next level, it can automatically enter into the next level and enjoy the income of the corresponding level (for example, VIP2 is 7%, VIP3 is 10%).

It is also worth noting that for each VIP level team, there is an upper limit on the investment amount for a single investor in this level. For example, in a VIP1 team, a single investor in a VIP1 team has a weekly investment limit of 5,000 USDT, while a single investor in a VIP2 team invests has an upper limit for a weekly investment of 10000 USDT. IMC encourages more people to participate into the game, and further restricts the excessive diving up of profits by a single user who holds an overly high amount of capitals (to prevent the giant whale effect).

In addition to the rewards that investors will receive according to their levels, they will also receive further dynamic benefits. This dynamic income is related to the lower-level users that the investor invites to participate in the IMC quantification. For example, if you are currently VIP5, then you will receive 2% of the total pledge amount of your direct subordinate at the level of VIP4 on the day as a bonus, the calculation method is 15%-13%=2%. If you are a VIP4, then you will receive 3% of the total pledge amount of your direct subordinate at the level of VIP3 on the day as a bonus, the calculation method is 13%-10%=3%. And so on, your bonus value is your tier’s bonus percentage minus your immediate subordinate’s bonus percentage. Of course, if your subordinate is at the same level with you, the team pledge bonus he can provide you will change to 1%.

Let’s say if you have recommended 6 people to participate in the IMC quantification (assuming the levels of these people are: one level 5 user A, one level 4 user B, two level 3 user C and D, one level 2 user E and one level 1 user F ), and you are at VIP5 level, it means that all these 6 people can bring you dynamic pledge income.

So in addition to the corresponding benefits you can get at the VIP5 level, the way that your subordinates bring you dynamic benefits will be:

A invests 1% of the total pledged funds + 2% of B (15%-13%) + 5% of the total funds of C and D (15%-10%) + 8% of E + 15% of F

This means that once a user recommends his/her subordinate investors to become quantitative users of IMC, all these people will bring the user dynamic pledge income.

In addition, each user can enjoy up to 5 levels of referral rewards. Let’s say if you have recommended A, A has recommended B, B has recommended C, C has recommended D, and D has recommended E. Then you will get 8% of the static income of the day that A can acquire, 6% of the static income of the day that B can acquire, 3% of the static income of the day that C can acquire, 2% of the static income of the day that D can acquire, and 1% of the static income of the day that E can acquire.

Examples of yields:

User A had chosen a 90-day static income product and participated into the VIP5 team and invested 50,000 USDT.

On the same day, A had recommended B and C to join the VIP4 and VIP3 teams respectively, and they had invested 30,000USDT and 10,000 USDT respectively, while B had further recommended D to join the VIP2 team and made D invest 5,000USDT. They had both chosen 90-day static income products. (The calculation of income is counted per the scenario with no reinvestment, under the circumstance of reinvestment, the yields will be higher)

Then A will get three benefits:

Income 1: Static income: 50000 USD*1%=500USDT

Income 2: Dynamic pledge income:

50000*15%=7500USDT

50000*15%+B: (30000+D: 5000)*(15%-13%)+C:10000*(15%-10%)=8700 (this income is only available as a one-time income when A’s subordinate users successfully pledge each time and ≥60 Days)

Income 3: Team static income:

30000*1%*8%+10000*1%*8%+5000*1%*6%=35USDT

So A’s one-day income is 500+7500+1200+35=8785USDT

The annualized rate is 6413.05%, far exceeding all DeFi products.

It can be seen that the income system of the IMC’s quantitative ecology is bringing lubricant incomes to investors. Especially in the long-lasting bear market, IMC’s quantitative products are expected to become the optimal solution to the income dilemma under the bear market.

I’m a highly experienced and well-respected author in the cryptocurrency field. I have written numerous articles and books on the subject, and my work is highly sought after by both industry insiders and regular investors alike.

Cryptocurrency is a relatively new and complicated field, but I can make the complex concepts easy to understand for even the novice investors. My writings would be beneficial for anyone looking to get serious about making money in this exciting new market.

In addition to my writing, I’m also an active investor myself, and have made a significant profit from investing in cryptocurrencies. I frequently speak at investment conferences and seminars to share my knowledge on the market with fellow investors.