Advertisement

Bitcoin and the crypto market, in general, have been performing rather well over the past few days. On Thursday, the OG crypto soared to $9,500, shrugging off the criticism projected by Goldman Sachs investment bank.

The bitcoin rally appears to have cooled off for now as BTC hovers around $9,545 at the time of publication. However, a particular trend that happened right before bitcoin spiked to a whopping $20,000 in 2017 just happened once again.

Last Time This Trend Was Seen, Bitcoin Entered A Fully-Ledged Bull Market

Onchain analytics firm Glassnode observed that bitcoin investors are seriously hodling, with 60% of the bitcoin supply remaining stationary for over a year. The last time such a massive amount of BTC supply remained unmoved on the blockchain was just before the 2017 bull run that sent BTC to $20,000.

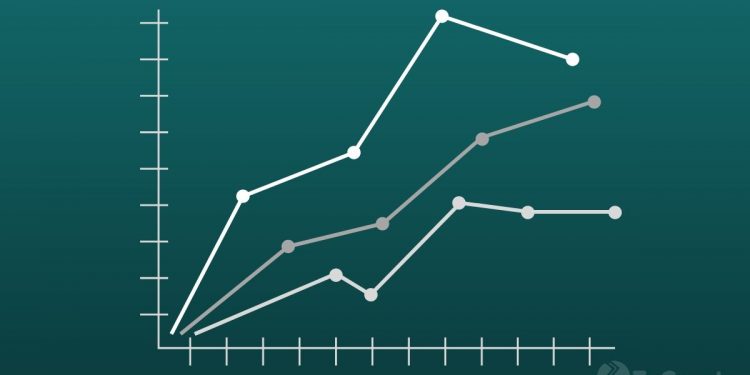

Glassnode captioned a chart that shows a clear correlation between the bitcoin supply remaining untouched and the upward price action that follows.

It should be noted that this trend is not the only signal suggesting a bull market is on the horizon. A trader with the moniker BTC_JackSparrow noted that BTC just printed a continuation pattern that is sufficient to catalyze the next bull run that may put bitcoin above $10,000.

Timing concept results were decent, we did pivot around the 18th and the 24/25th$BTC printed a different pattern than I anticipated, but in my opinion still a continuation patternI think we test 9250-9350 once more and do a crazy June rallyLast time below 10K? Possible https://t.co/xiW8iFTnWT pic.twitter.com/ANLdM2gho7— //Ethereum ack 🐐 (@BTC_JackSparrow) May 29, 2020

Fundamentals Corroborate The Bullish Narrative

It’s not just BTC’s technicals that are showing signs of strength, its fundamentals are booming as well.

ZyCrypto recently reported that Grayscale Investments, which is emblematic of institutional demand, has been accumulating huge amounts of bitcoin in recent months.

Also, the United States and China have rekindled their two-year trade war over Beijing’s suspected culpability for COVID-19 and its increased control over Hong Kong. Last year, BTC rallied as this trade war escalated. Analysts eye such a similar occurrence again this year.

Moreover, the Federal Reserve has indicated that it is willing to do whatever it takes to rescue the dying economy. The liquidity injections make a compelling case for bitcoin which has an unforgeable scarcity. It is expected that more people will turn to the crypto to hedge against runaway inflation that will be caused by the insane money printing.

Get Daily Crypto News On Facebook | Twitter | Telegram | Instagram

DISCLAIMER Read MoreThe views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

I’m a cryptocurrency and blockchain technology writer. My work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and VentureBeat. I’ve been a respected voice in the cryptocurrency community and my insights into the industry have helped shape its development.